Why is life insurance important to have?

Life insurance is for those you love and could leave behind. It can also diversify your savings to help you live life to its fullest. Each type of policy offers a different type of benefit, so your coverage can grow and adapt to your changing needs. No matter where you are in life, life insurance offers a variety of products designed to help you with all of life's major events.

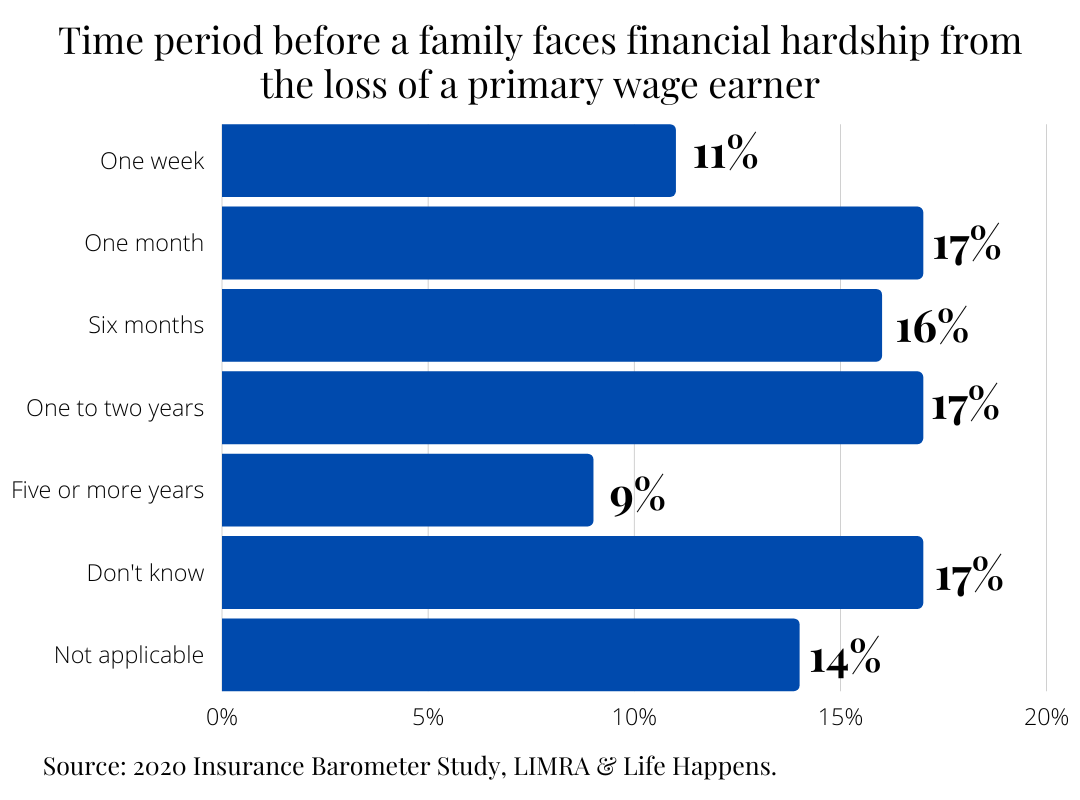

Would your family face financial hardship if you passed away unexpectedly?

How would an unexpected death impact your family?

If you’re the primary wage earner for the family, is your family in a position to handle the financial hardship they could face?

If you are the major breadwinner or a major contributor to family income, you should be insured. A life insurance policy can mean the difference between your family keeping the home in which you live and losing it to debt if you are no longer able to provide for them.

Life Insurance for every stage of life’s journey

Living the single life

Take your burdens with you

Life insurance can pay expenses when you’re gone. Think about your funeral, private or co-signed student loans, and any other debt. And if you outlive your single days, you’ll diversify savings early and lock in a lower cost while you’re young and healthy.

Tying the knot

Help your spouse continue the lifestyle you’d created.

Life insurance can replace your income, covering your portion of the ongoing expenses they’ll still have. And it can pay for large expenses, like the funeral, or personal or shared debts like a mortgage.

Raising children

Give them the same experiences and opportunities.

Life insurance can’t replace a parent, but it can help with final expenses and replace income. Then others can afford to raise the kids as you’d planned, save for college and emergencies, and pay for family responsibilities you handled.

Empty Nesting

Safeguard the retirement of your dreams.

Life insurance can still help replace income, pay for final expenses, and address debt, so your spouse can afford retirement on their own. And living benefits can also help with unexpected medical costs, so you don’t dip into retirement savings too soon.

Relaxing in retirement

Live the lifestyle you earned, and leave a legacy, not a liability.

Life insurance can help you leave a legacy— inheritance to loved ones or charities instead of debts and bills. And until then, certain policies can supplement retirement income and provide access to cash if you become chronically ill.

Own a business?

Protect your business, your employees, and your lifestyle.

Life insurance can fund business succession strategies, supplement your retirement savings, protect and reward key employees, cover debts for creditors, and more.

Life Insurance Solutions

Term Life Insurance

Temporary life insurance plans with Low-cost death benefit protection for a specified period of time. Conversion options to permanent life insurance products are offered with some plans.

Whole Life Insurance

Permanent life insurance protection with guaranteed level premiums, cash value growth, and death benefit. Some policies pay dividends that can be used to reduce premiums or increase cash values and death benefits.

Universal Life Insurance

Permanent life insurance protection with flexible premium payments and death benefits. UL policies also build cash value that can be accessed by the policyholder for financial emergencies or opportunities.

Life Insurance As An Asset

The financial benefits of cash value life insurance

Pay fewer taxes in retirement

A cash value life insurance policy can provide a source of tax-free income to supplement taxable income from assets such as a 401K, or individual retirement account (IRA). Life insurance also offers the following benefits:

- Income tax-free death benefit to your beneficiaries

- Tax-deferred cash value growth

- No penalty for withdrawals prior to age 59 1/2

- No income-based funding limits

Prepare for health surprises

Select life insurance policies include an additional coverage option that allows you to receive a portion of the death benefit typically paid at your death if you are diagnosed with a chronic illness. It gives you a way to offset medical costs while preserving your retirement nest egg for you and your family.

Get more value for your money

Most assets take time to accumulate value. With life insurance, there is no build-up period. Your policy's death benefit is available to your loved ones whether you've been paying premiums for 40 years or just one.

Carrier Partners

Frequently Asked Questions

-

Most people overestimate the cost of life insurance by 300% or more . The cost varies based on your unique situation. The biggest factors that can affect your premium include your coverage amount, term length, age, health status, and tobacco use.

The sooner you buy, the sooner you'll lock in your lowest premium–and save the most money in the long run.

-

Employer-sponsored policies typically offer coverage that is about 1-2X your annual salary, which is a fraction of what most families need. And if you leave your job, that coverage usually ends. A common rule of thumb is to have 10X your salary in life insurance protection, which is why many people buy individual term policies to supplement their coverage through work.

-

Life insurance policies have a 30-day free look period. If you cancel the policy within the first 30 days, you will receive a full refund of premium paid. After 30 days, you may cancel your policy at any time without cancellation fees.

-

A common and easy way to come up with a coverage estimate is to multiply your annual income by 10. Another way is to calculate your long-term financial obligations and then subtract your assets. The remainder is the gap that life insurance needs to fill.

Contact Us

Please use the form below for any questions, or comments or to request a quote.