Get the keys to a financially secure, worry-free life

Let's work together to get your financial house in order. Through comprehensive financial planning, together we can prepare you for all of your major life events.

You will get assistance in eight important areas of your financial life. We will follow a step-by-step process to overcome every financial challenge you have. This will be a journey that will change your mindset, and relationship with money so you can begin creating the best life possible, for yourself, and those important to you. You will get the comprehensive financial literacy you didn't receive during your formal education.

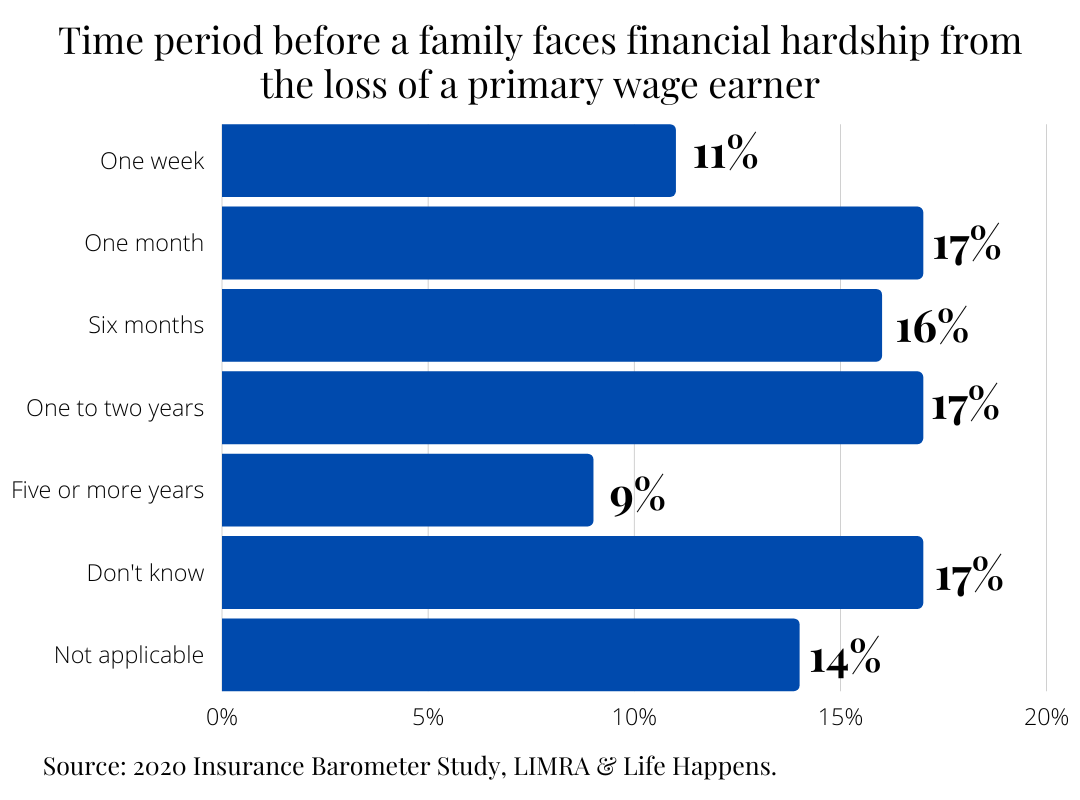

Are you taking your financial vulnerability into consideration?

you should consider how an unexpected death would impact your family. If you’re the primary wage earner for the family, is your family in a position to handle the financial hardship they could face?

A holistic financial plan will ensure you have adequate savings and assets in place to protect your family from unexpected sickness, disability, unemployment, and premature death.

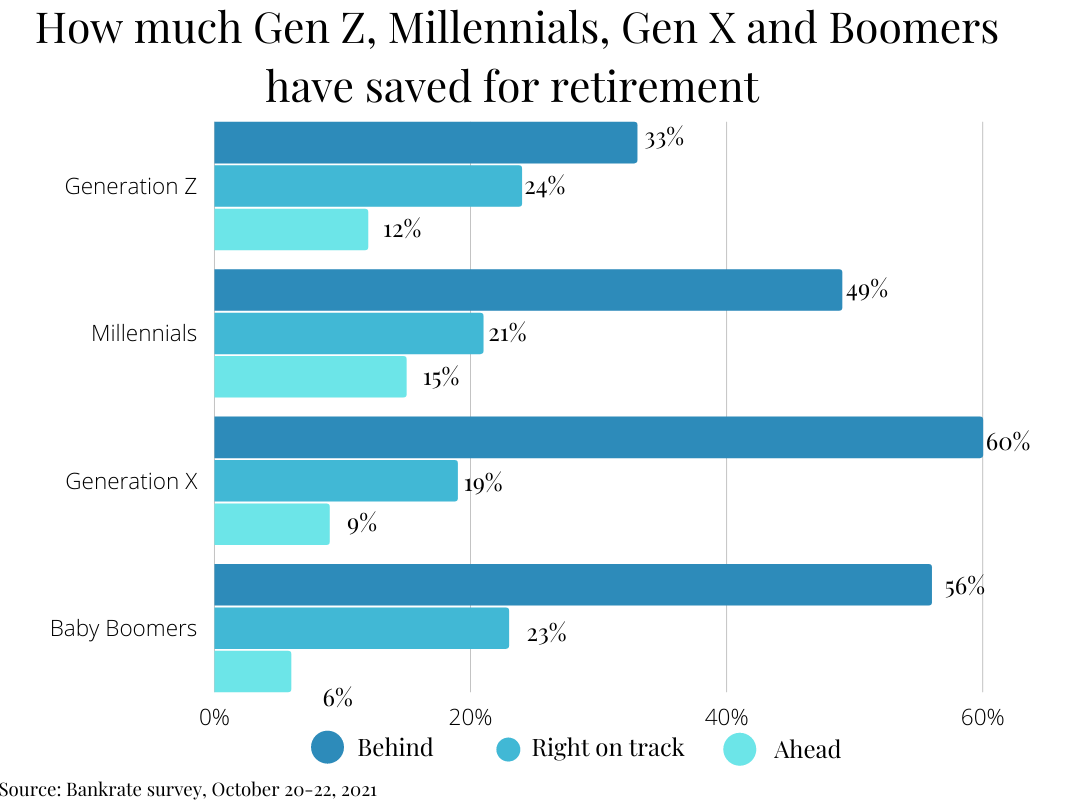

Are you saving enough to achieve your retirement goals?

Are you utilizing the right balance of retirement vehicles to accumulate the required assets needed to live comfortably during retirement?

When taking a close look at the possibility of outliving your savings, you should consider the recent trends toward retirement savings. Looking at Millennials, Gen X, and Boomers, you can see the trend that many Americans are behind in their savings for retirement, regardless of their generation.

Financial Planning Services

Get assistance in one or more areas of the financial planning process

Make it happen

Improving your cashflow

We will work with you to create a flexible and easy-to-follow budget that will improve your cash flow and allow you to invest for the future.

Debt management

We will review your debt situation, determine if it is concerning and help you implement debt elimination strategies you can easily follow.

Insurance planning

We will review the protections you have in place to ensure the essentials are covered. We will help you put measures in place to protect your quality of life from unexpected sickness, disability, unemployment, and premature death.

Estate & Legacy Planning

We will review your estate planning documents and help you effectively implement one to preserve your assets. You will learn how to create generational wealth and efficiently pass on your assets without losing their value.

Tax minimization strategies

We will work with you to implement effective tax minimization strategies to increase your take-home income.

Wealth building strategies

We will determine your risk tolerance and help you develop wealth-building strategies to meet your unique needs. You will learn the important keys to multiplying the growth of your savings and how to properly diversify your assets to lower your exposure to market and economic risks.

Tax-smart retirement planning

We will help you put together a plan to turn your life savings into lasting retirement income. You will gain a deep understanding of how to overcome all the risks to a comfortable retirement. You will understand how to maximize your retirement income, lower your exposure to taxes and protect your investments from market volatility in your golden years.

Asset protection & wealth preservation

We will help you implement effective and simple protection to preserve your assets. Asset protection is not just for the rich and wealthy. People at any income level should have a plan in place to protect their assets from creditors, lawsuits, bankruptcy, and unnecessary taxes. Asset protection works best when done far in advance because on your journey to gain your riches is when you are most vulnerable.

Service Plans

30-Minute Financial Consultation

Deliverable: Personal action plan to resolve your financial matter

2.5 Hour Financial Consultation ($300)

Deliverable: Financial action plan with recommendations to resolve your financial matter

5-Star Financial Plan ($1,000)

This will include:

- Cash flow management to increase your savings

- Insurance and estate planning review

- Risk assessment and asset diversification

- Wealth planning strategies

- Tax minimization and wealth transfer strategies

- Lifetime annual plan reviews

Frequently Asked Questions

If I'm not happy with my purchase can I get a refund?

Please in get contact at any time if you're not satisfied with your services. We do our best to ensure all clients are happy and need to determine on a case-by-case basis the eligibility of refunds.

How does appointment scheduling work?

When you've completed purchasing you'll be able to login to your client account and can find out the next steps required to book a time for your appointment from there.

Is it possible to buy planning services more than once?

For sure! You simply need to purchase services again and will be able to get access to another set of financial planning sessions.

Contact Us

We'd love to hear from you! Please contact us using the form below for any questions or comments.